Correction Confusion and Concern

Published | Posted by Violet Leff

No doubt our local area housing market is in correction mode, along with the rest of the US housing market. Ours is well evidenced by price reductions, longer days on the market and a huge drop in buyer demand meaning less pending contracts and less sales. Year over year pending contracts dropped by 50% in our area, along with a 40.5% decline in sales year over year. The drop in demand is in large part the result of the significant increase in interest rates since the beginning of the year.

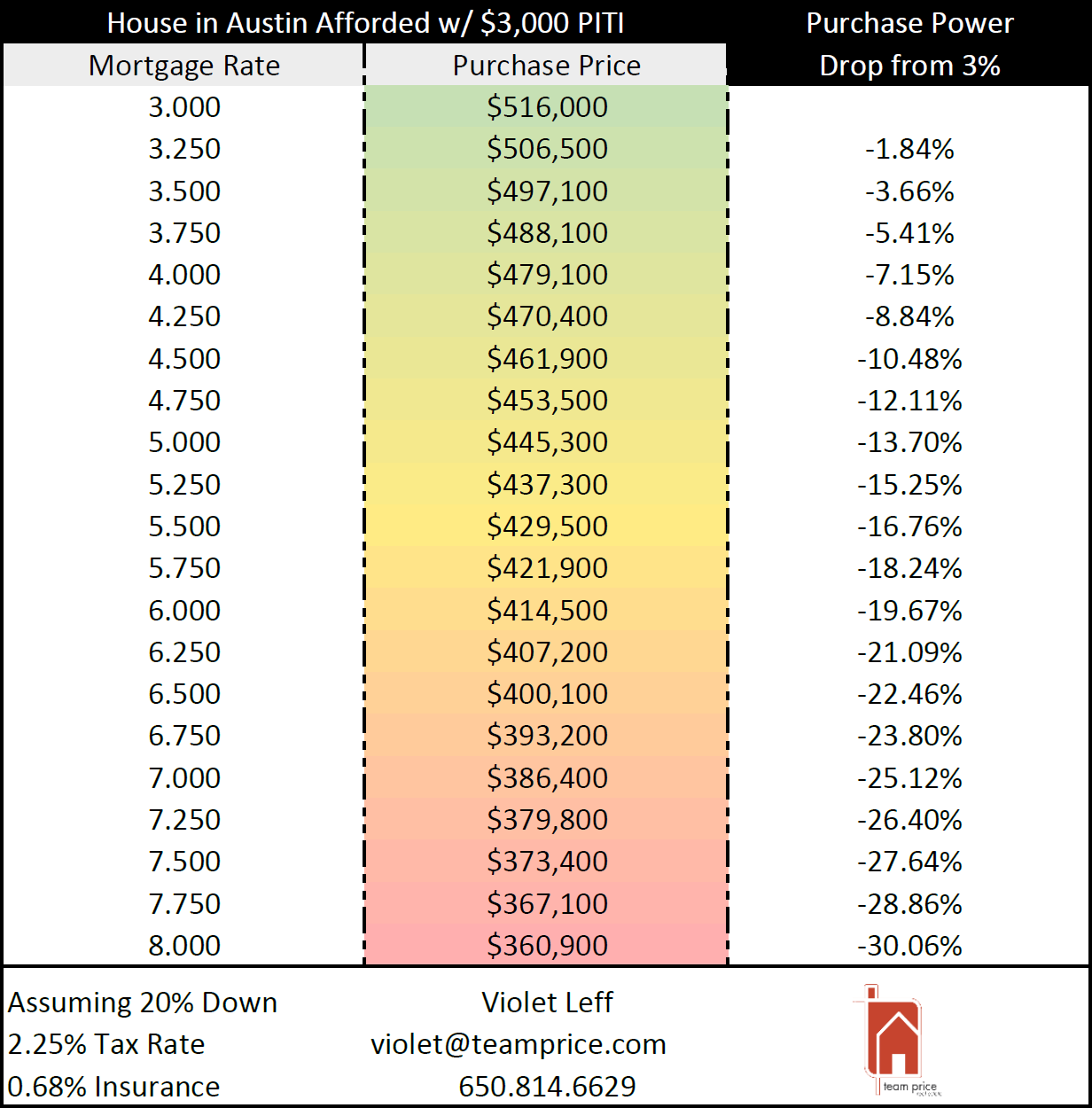

Even with price reductions (some at significant amounts), prices still remain high and that along with current mortgage rates, has impacted buyer purchasing power. While local rates currently hover at around 7%, we could see them reach 8% or more by years' end.

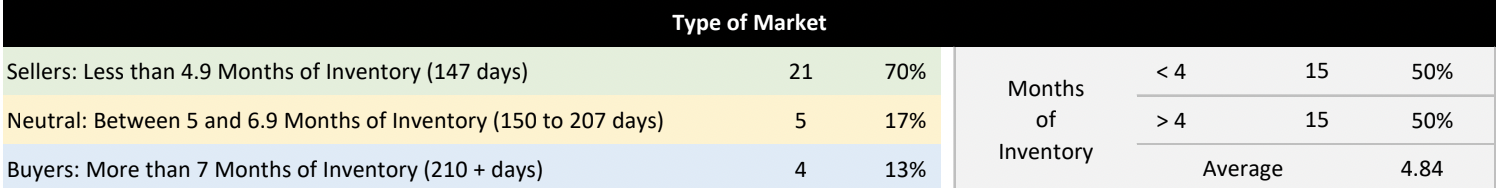

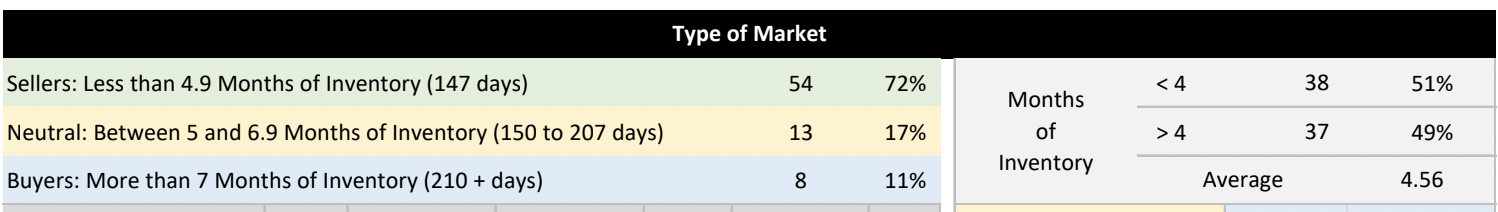

There is some silver lining though. Of the 30 cities in the area 70% are still in a sellers market, 17% in a neutral market, and 13% in a buyers market. See the first chart below. However, real estate is hyper-local, not only MSA, county or city, but zip code too, as shown in the second chart. We seem to be moving more towards a neutral market relative to active inventory. The higher inventory levels we have is essentially making home buying a little less frantic for buyers and giving them more choices. And although purchase power has taken a hit, sellers have been more willing to negotiate not only on price, but repairs, and contributions towards closing costs and buying down interest rates.

The Austin area still has a strong economy that’s more diversified than ever with tech, manufacturing and life sciences industries adding to the mix of employers and adding to job opportunities.

Related Articles

Keep reading other bits of knowledge from our team.

Request Info

Have a question about this article or want to learn more?